作为必要的服从事项, banks routinely risk-score their customers to ensure they comply with their pre-defined risk-appetite. Whether during onboarding or through monitoring customers and transactions, 每个实体都要经过主要金融犯罪部门的审查, 通常分为:了解你的客户(KYC), 反洗黑钱/反恐怖主义融资(AML/CTF), 制裁, 欺诈, 以及交易和客户监控.

然而, 大多数实体审查都是在业务竖井中进行的, 每次评估通常在不同的系统中进行, 由不同的策略和流程执行, with a lack of centralized customer data to provide a holistic view of a customer.

通过单独评估, different risk-scores or versions of the same entity can exist and cause complications for the bank. 例如, a customer with a business loan could have been identified as a Politically Exposed Person (PEP) 但 their business account rates them as a low risk customer.

This can lead to customer fragmentation, data duplication or multiple records of a single entity. 结果是, many financial crime departments in banks lack efficiency and have not leveraged the technological potential to create an enterprise-wide, 单客户视图.

实体解析/单一客户视图

实体解析(ER)是 金融犯罪风险管理的白衣骑士. ER can untangle the digital web of complex customer data to create a holistic, real-time view of their customers and the networks they interact with. Stitching together the data from different internal systems and augmenting it with external data will modernise the ability for banks to fight financial crime. Artificial Intelligence can further be used to improve analysis of a customer’s risk, being able to better explain certain behaviors or relationships hidden in the data.

ER also brings the promise of enhanced analytical capability by combining disjointed data systems. A consolidated customer profile will mean a superior monitoring capacity, 更有力的客户尽职调查, 自动报告, 简化流程, 增强的可追溯性和更好的数据沿袭. 也许最重要的是,能力 执行企业范围的案例管理 will be a giant leap forward in conducting financial crime investigations. The benefits don’t just stop at the operational level 但 using data to create a 单客户视图 can help enhance a bank’s reputation for security, 提高客户保留率和, 最重要的是, 提升银行打击金融犯罪的能力.

技术实现

银行的意图往往是正确的, 被积极的人所驱动, 但, 一旦成本和复杂性开始增加, 他们可以选择一条更容易的道路. Implementation of entity resolution will require heavy investment in technology and security; uplifting of policy, procedures and governance; and most likely a structural re-organization to integrate all financial crime risk management portfolios under a synthesized framework. 是的, 这是一个很大的咀嚼, 但 the dividends are significant and will be a bank’s best bet at providing customer and institutional security in the future. 借用纳尔逊·曼德拉的话, 在事情没有完成之前,总是看起来不可能.

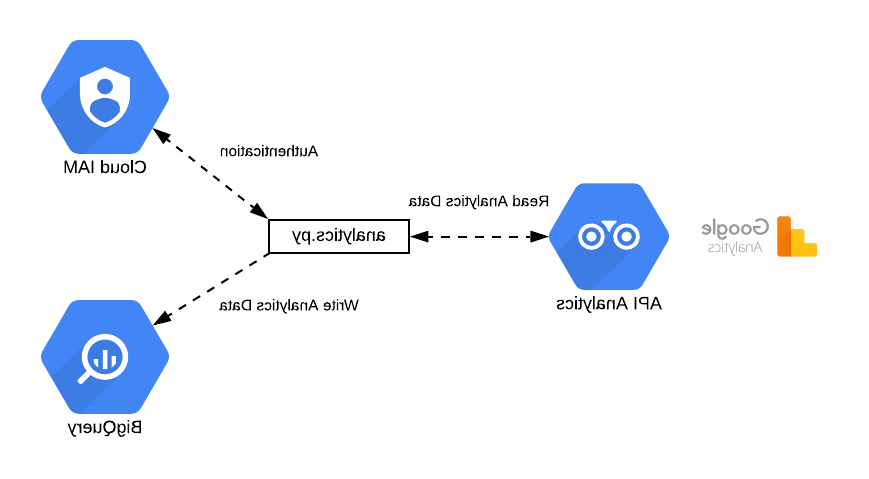

Fortunately, in many cases the necessary data to complete a 单客户视图 already exists. 所面临的挑战, 然而, lies in bridging the vast volume and velocity of data and putting it in a format that can be read across different systems. 有 three main data initiatives that banks can take to make the step towards entity resolution:

- 删除重复数据的副本

- Finding records that reference the same customer or entity in different systems and linking them

- Standardizing the form of data that had previously been represented in multiple forms, 也被称为“规范化”

其他全球参与者包括 在这方面已经领先于英国. The Social Security system in the US provides each citizen with a unique ID number that records an individual’s income or wages, which can be used by financial institutions to check their credit score or other require information about an entity. 在整个欧洲, Norway’s BankID and Iceland’s Kennitala system give citizens a single numerical identifier that provides each person with access to every bank and public agency, and the relevant administration authorities with a centralized repository of customer records. 在中国,大型科技和金融服务公司, 比如蚂蚁金服, are consolidating the huge mass of customer data at their fingertips to create a visual network view of all of a customer’s interactions – both financially and socially.

英国机构 还有很大的发展空间. 根据 这是NICE optimalize对90名fi人士进行的民意调查, 领先的统一客户视图提供商, over 50% of banks with at least US$60billion in assets have over 10 detection systems, 另有31%的人拥有超过20个孩子.

有 more efficient ways to perform necessary anti-financial crime checks. Assigning a single number or unique identifier to all of the data associated with one entity across a network is a good starting point. 此外, it is worth noting that the World Bank advocates that having a Unique Identified Number (UIN) through civil registrations systems is critical to achieving the 联合国可持续发展目标 (目标16.9).

单个客户视图的多种用途

Aside from financial crime, the use cases for entity resolution are immense. 从优化营销, 资源管理, 到专业服务, knowing the context of your customers can only serve to improve your personalized business offerings. Predictive analytics can be much more targeted with a better understanding of individualized customer needs.

A holistic customer risk rating through a 单客户视图 may not be the norm yet, 但随着银行合规文化的发展和深化, 这无疑是一个必要的目标.